Pros and Cons for the New WooCommerce Payments

The WooCommerce team released WooCommerce 4.1 in early May, and with it came two big new features: The Marketing Hub, and WooCommerce Payments. Today we’re going to look into WooCommerce Payments, how it can improve your business, some of the potential downsides, and under what circumstances you should look into using it.

Where You Can Find WooCommerce Payments

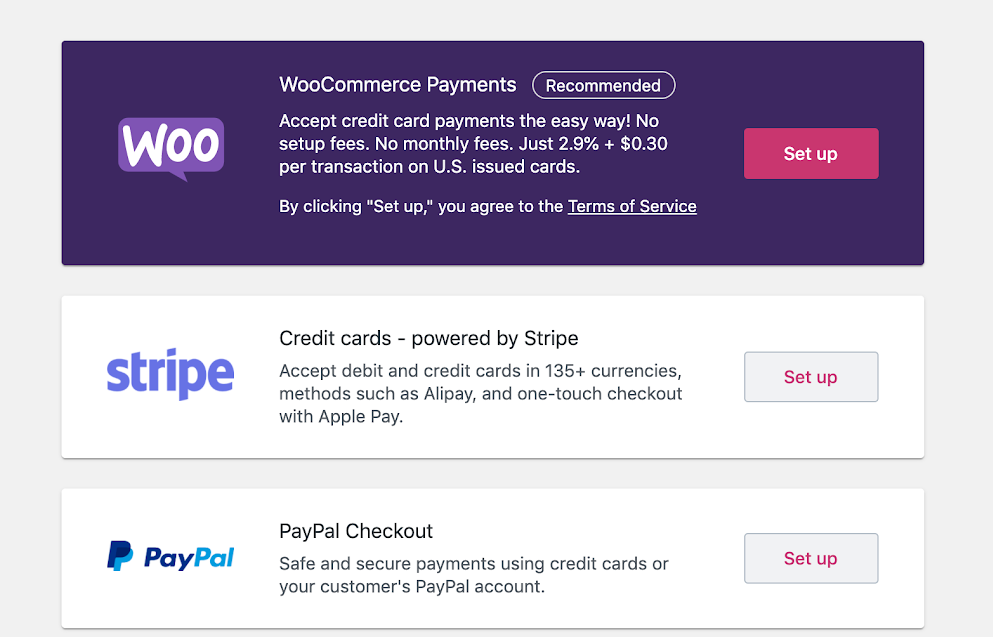

Before we get to what WooCommerce Payments does, it’s worth sharing where users can expect to find WooCommerce Payments. It’s built right into the welcome wizard, so every new store owner will see this as an option. And unless you already have experience with eCommerce, and you have a favorite payment gateway (pretty sure I’m the only one that nerdy), you’re likely to choose WooCommerce Payments because it’s made by the same company and has WooCommerce in the name.

WooCommerce Payments is currently only available in the US for stores that use US dollars. So if you don’t see it in the welcome wizard and you are located outside of the US, that’s most likely why.

Their plan is to slowly add more countries and currencies over time. Based on WooCommerce’s international appeal, I expect support for Canada, the UK, and other Western European countries to come next.

Note: if you want to use WooCommerce Payments and you’re outside of the US, you can sign up to be notified.

What You Can Expect from WooCommerce Payments

Payment gateways do two essential things:

- Accept and process credit cards 💳 on your site

- Manage payments, refunds, disputes, and deposits.

And WooCommerce Payments does all of these. 😎

Best of all, WooCommerce Payments does all of this within your site. So you can not only accept credit cards on your site (which is commonplace and best practice), you can also manage payments, refunds, and disputes from your WordPress admin.

Being able to do all of this reduces a lot of friction for store owners. First, it’s one less account you have to manage, and one less username/password you have to get from a client or share with a developer.

It also allows a store owner to do everything from one interface. Since it’s only two clicks to move from the order screen to the transaction screen where I can view the payment details, including fraud risk, previous transactions, and fees, it’s more likely I’ll check those details out. You can also view and manage deposits from WooCommerce Payments into your business bank account.

This gives store owners a more well rounded understanding of their business, and when you do need to review potential fraud, see when your next deposit will hit your bank account, or dig into financial details it’s going to save so much time.

This extension makes WooCommerce the hub for your business, instead of simply the place where you update your products.

Requirements for WooCommerce Payments

Before adding WooCommerce Payments, make sure your infrastructure meets these minimum requirements:

- PHP 5.6+

- WordPress 5.3+

- WooCommerce 4.1+

- Jetpack 5.3+ (this is a temporary requirement)

- An SSL certificate (to use the payment gateway in live mode)

Note: PHP 7.3, free SSL certificate, and the latest version of WordPress, WooCommerce, and plugins are included for those on Managed WooCommerce hosting at Hostdedi.

Why You Should Trust WooCommerce Payments

I have used WooCommerce for years and trust them to build high-quality, functional, and customizable eCommerce software.

But accepting payments is an entirely different field, so you may have some concerns.

Luckily for all of us, WooCommerce is focusing on what they do best: eCommerce software. WooCommerce Payments is a white labeled version of one of the best and most popular payment gateways on the market: Stripe.

If you’ve used Stripe, you know they’re incredibly reliable and offer transparent pricing.

Limitations of WooCommerce Payments

Beyond being limited to the US and using US dollars, there are a few limitations to be aware of, including functionality, compatibility with 3rd party applications, loss of historical data, and your fees.

Limited Functionality

I’m a huge fan of recurring revenue, and one of the most powerful recurring billing features in the entire eCommerce landscape is WooCommerce Subscriptions.

Right now you can’t use automatically recurring payment with this gateway. So if Subscriptions are a big part of your business, I recommend staying with your current payment gateway.

Compatibility with Apps

Another great thing about Stripe is that a lot of infrastructure has been built directly on top of it. Some applications, such as Baremetrics, have a direct integration with Stripe.

So, if you use an application like Baremetrics or another bookkeeping or accounting application, you would have to enter all of that data manually. I’d recommend sticking with your current setup for now.

Cannot Import Historical Data

It should come as no surprise to anyone who knows me that I’m a huge data nerd. If you’ve been in business for a few years, you have a huge amount of data about your customers, including how much they purchase and how often.

A lot of this data should be in WooCommerce, but some data is saved in the payment gateway, and currently you cannot import historical data into WooCommerce Payments.

If you’re a giant data nerd, or have very invaluable data that you don’t want to lose, you might want to wait until WooCommerce Payments lets you import your historical data.

Negotiated Payment Gateway Fees

One of the last points could be one of the biggest depending on the size of your store. The standard pricing with modern payment gateways like Stripe and WooCommerce Payments is 2.9% + .30.

What some merchants don’t know is that you can negotiate better rates once you start bringing in significant money. There aren’t any rates set in stone, but the rule of thumb is if you make over $80,000+ a month you can negotiate rates with your payment gateway.

You might be able to go from 2.9% + .30 down to 2.5% + 0.30. That’s a huge jump and helps increase your profitability. This might not seem like a lot for smaller stores, but if you make $1,000,000 in revenue, you could pay $29,000 in fees. With negotiated rates you’ll drop that to $24,000.

As much as I like the utility of putting a payment gateway directly in the WooCommerce admin, it isn’t worth $5,000 in additional fees. So, if you have negotiated rates, you’ll definitely want to continue with your existing payment gateway.

The Future

WooCommerce is putting a lot of effort into WooCommerce Payments as they expand territories, currencies, and compatibility with extensions and apps.

If you like the idea of WooCommerce Payments, it will very likely be coming to you soon. Some businesses will likely have to wait until the advanced features are added, or negotiated rates become possible, since that’s a huge money saver. But if you’re starting a brand new store, or you just started your store, I definitely recommend exploring WooCommerce Payments.

Patrick Rauland is obsessed with ecommerce. He’s built ecommerce websites for clients, worked for WooCommerce doing support, development, product management, and helped plan their yearly conference (WooConf).

He now helps people by writing on his blog, creating courses for LinkedIn Learning, and by writing books like WooCommerce Explained & the WooCommerce Cookbook.

Patrick is also the co-founder of WooSesh, an online conference for WooCommerce developers and store owners.

Patrick lives in Denver Colorado where you can probably find him at a local coffee shop typing away.